Transformers are considered by most regulatory agencies to be “mobile units” or “special equipment.” Unique accounting treatment is required that differs from accounting treatment on other equipment such as poles and conductor.

In the case of transformers, the utility is typically allowed to earn depreciation expense on the units whether they are physically installed and serving customers or sitting in the utility’s yard as spares. Transformers are recorded as “plant in service” in the year they are purchased, including first-time installation costs which often need to be estimated since they are not always installed in the same year as they are purchased.

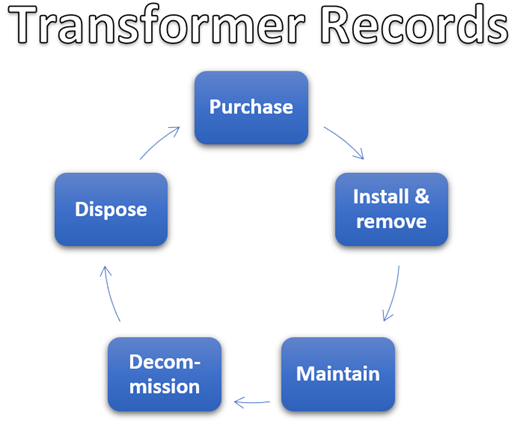

If you’re not an accounting person, but you’re responsible for keeping property records on transformers, we’ve got you covered! Just ask us for a user guide that will walk you through the process of maintaining these records, so they support operational, engineering and accounting functions for your utility. These records include the following activities: